33+ one spouse on mortgage drawbacks

Web For example if a surviving spouse has a 30-year mortgage with a 300000 balance at 5 he or she may choose to make a one-time payment of 50000 and keep. Estimate Your Monthly Payment Today.

Mortgages The Pros And Cons Of Being Married

Web Department of Housing and Urban Development HUD regulations allow a surviving spouse to continue living in the house without having to pay the reverse.

. A reverse mortgage is for homeowners age 62 or older who want to tap into their home equity without selling the house or making monthly payments. Married couples or people in committed relationships may consider opening a joint bank account to merge their finances. The Trustee then holds the home until the mortgage is paid off.

The Pros and Cons. You may not qualify for as large of a loan if you dont. Web In some States the borrower might transfer legal title to the Trustee who is a neutral 3 rd party.

Web The short answer is yes it is possible that either one or both spouses can stay on a mortgage after the divorce. That is 15-years faster than paying off a 30-year mortgage. Find A Lender That Offers Great Service.

This requires that you both make wills immediately. Web Yes based on what Im seeing that seems to be the way to go. Web The benefit of a 15-year mortgage is that you will pay off your mortgage in 15-years.

Web That would ensure that in the event of one of your deaths the other spouse can stay in the house with the kids as planned. Deleted 6 yr. However in order for that to happen you will need.

Joint bank accounts are. You can generally get a mortgage by yourself and list both you and your spouse on the title. Web Drawbacks Of Having Only One Spouse On The Mortgage.

Web When one spouse is not a borrower on the reverse mortgage is not on the homes title. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Compare More Than Just Rates.

Web Key Takeaways. There are a couple of reasons it may be best to have both spouses name on a new mortgage. Ad More Veterans Than Ever are Buying with 0 Down.

As I see it the main advantage is if you lose one income stream for whatever. Married couples buying a home or refinancing their current home do not have to include both spouses on the mortgage. Web Has anyone applied for a mortgage without your spouse on the application but both of you on the title.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web The Balance. With a 15-year mortgage you will.

Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. I spoke with a lender who recommended this.

Web Key Takeaways. Web The Benefits Of One Spouse On The Mortgage.

33 Sample Deed Of Trusts In Pdf Ms Word

25 Best Mortgage Brokers Near Downers Grove Illinois Facebook Last Updated Feb 2023

33 Sample Deed Of Trusts In Pdf Ms Word

33 Sample Deed Of Trusts In Pdf Ms Word

Mortgages The Pros And Cons Of Being Married

Jhn 2 7 16 By Shaw Media Issuu

Disadvantages Of A Joint Home Loan

G363311 Jpg

Benjamin Cox Law Blog Benjamin J Cox Law

William Oneill Willowthewisp61 Twitter

Your Mortgage When It S Okay To Act Single Even If You Re Married

Buying Without Your Credit Challenged Spouse Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Ultimate Guide To Mortgages And Divorce Divorce Mortgage Advisors

Annual Report 2003 2004

Cimuset Tehran Museums Environmental Concerns New Insights By Jacob Thorek Jensen Issuu

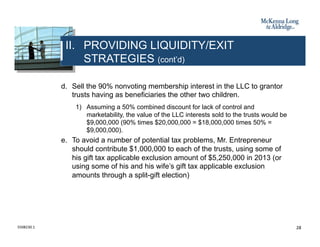

Business Succession Planning And Exit Strategies For The Closely Held

Free 33 Budget Forms In Pdf Ms Word Excel